The model is straightforward: buy, hold, and sell your metals through an industry leader. And when it comes to investing in gold, British Coins are the most effective means of investment as they carry no CGT and VAT on gold. At Bullion House, we cater to all budgets, with new investors typically spending between £5000-£10,000 on metals.

Gold has long been seen as a safe haven for investors during times of economic uncertainty. And this year, the gold market has started off strong, providing a stable investment opportunity for savers worldwide. With the most economies facing a period of hardship, now more than ever, investors are looking for ways to protect their wealth. That’s where Bullion House comes in, offering a turnkey solution for those seeking to invest in gold.

While storage options are popular, the current trend is to have the metal in one’s possession. Coins are an easy and enjoyable way to accumulate wealth over time, and we offer a range of coins to suit all tastes and budgets. Whether you’re a seasoned investor or just starting out, Bullion House makes investing in gold accessible and straightforward.

In the US and UK, gold has always been seen as a solid investment option. However, we’ve recently seen a new wave of interest from Gen Z investors and ISA holders in the UK seeking higher returns on their savings. At Bullion House, we aim to provide an alternative to traditional bank accounts and offer a smooth investment process from start to finish.

So, if you’re looking to protect your wealth and invest in gold, get in touch with Bullion House today. As the rush for gold becomes a popular term again this tax year, let us help you make the most of this stable investment opportunity.

Reasons to have your assets in your possession

- Control and security: When you own physical assets, such as gold coins or real estate, you have complete control. You can store your items in a secure location of your choice, ensuring that they are safe from theft or damage. This gives you peace of mind and reduces the risk of your assets being lost or stolen.

- Protection against market volatility: Physical assets can act as a hedge against market volatility, as they are not subject to the same fluctuations as paper assets like stocks and bonds. This means that even if the stock market crashes or the economy takes a downturn, your physical assets will still retain their value.

- Tangible value: Physical assets have tangible value, meaning that they can be used or traded regardless of the economic climate. This is particularly true for assets like gold, which has been valued for thousands of years and can be easily exchanged for cash or other goods.

- Inflation protection: Physical assets can protect against inflation, as they are not tied to the value of a currency. This means that even if inflation rises, your physical assets will still retain their value and purchasing power.

- Diversification: Owning physical assets is an important part of diversifying your investment portfolio. By holding a variety of assets, you can spread your risk and reduce the impact of market volatility on your overall portfolio.

In summary, having physical ownership of your assets provides you with control, security, protection against market volatility, tangible value, inflation protection, and diversification. These benefits make physical assets an essential part of any investment strategy.

Gold Vs Alternative Investments

When it comes to alternative assets, gold is often considered one of the most stable and reliable investments. Compared to other alternative assets, such as real estate or cryptocurrencies, gold has a long history of being a safe haven during times of economic uncertainty.

Real estate, while often considered a reliable investment, can be affected by local economic conditions and can be difficult to sell quickly. In contrast, gold can be bought and sold easily and quickly, making it a more liquid asset.

Cryptocurrencies, on the other hand, are highly volatile and can be subject to rapid price fluctuations. While some investors have found success with cryptocurrencies, many others have lost money due to the unpredictable nature of these assets.

Gold, on the other hand, has a history of maintaining its value over time. It is a physical asset that can be held in one’s possession, providing a sense of security and stability for investors.

Overall, while there are other alternative assets available, gold remains a popular choice for investors seeking stability and reliability in their investments.

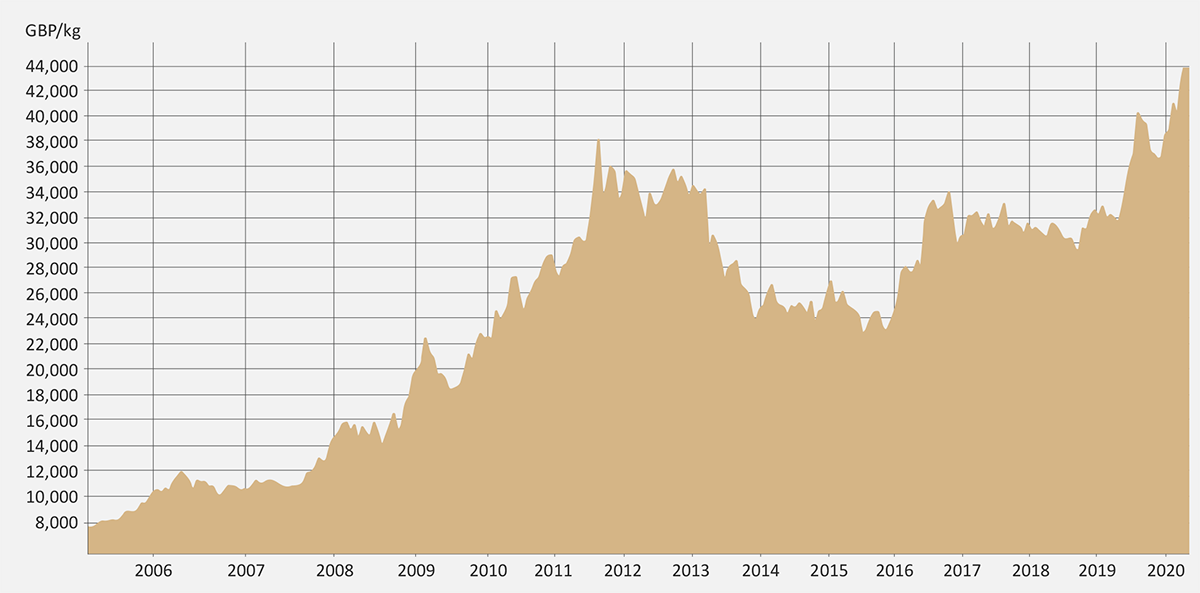

Historical performance

Gold has experienced several significant price increases throughout history, with some of the most notable periods of growth occurring during times of economic turmoil and geopolitical uncertainty.

One such period was during the 1970s when the US was facing high inflation, rising oil prices, and a weakened economy. In response, investors turned to gold as a safe-haven asset, causing the price of gold to skyrocket from around $35 per ounce in 1970 to over $800 per ounce in 1980.

Another significant period of growth occurred during the 2008 financial crisis when investors once again sought refuge in gold due to the instability of the stock market and concerns over the global economy. Between 2007 and 2011, the price of gold rose from around $600 per ounce to over $1,800 per ounce.

More recently, the COVID-19 pandemic and its economic impact have once again led to an increase in demand for gold, pushing its price to record highs in 2020.

It’s worth noting that while these historical trends can provide insight into the potential performance of gold during times of economic uncertainty, the future price of gold is unpredictable and subject to a variety of factors. As with any investment, it’s important to conduct thorough research and see