Gold Bars Vs Gold Coins: What is better to buy?

The common question from new gold investors is, “Should I buy gold bars or gold coins?” Discover our concise guide that explains the pros and cons of both types of products.

CGT & VAT

Silver is a very small market—so small, in fact, that a little money moving into or out of the industry can impact the price to a much greater degree than other assets (including gold). This greater volatility means that in bear markets, silver falls more than gold. But in bull markets, silver will soar much further and faster than gold. We can expect this outperformance to repeat in the next bull market, too, because the silver industry remains tiny.

Storing Bars Coins: Book safes or secure vaults what do you need?

Please email [email protected] or call 02071172889 for information on safes and storage options.

Bars vs Coins

| Aspect | Gold Bars | Gold Coins |

|---|---|---|

| Premiums | Lower | Higher |

| Liquidity | Less liquid for large bars | Highly liquid |

| Tax implications | Subject to CGT | ALL British coins are CGT-free |

| Storage | Easy to store | May need special care |

| Entry cost | Higher | More affordable options available |

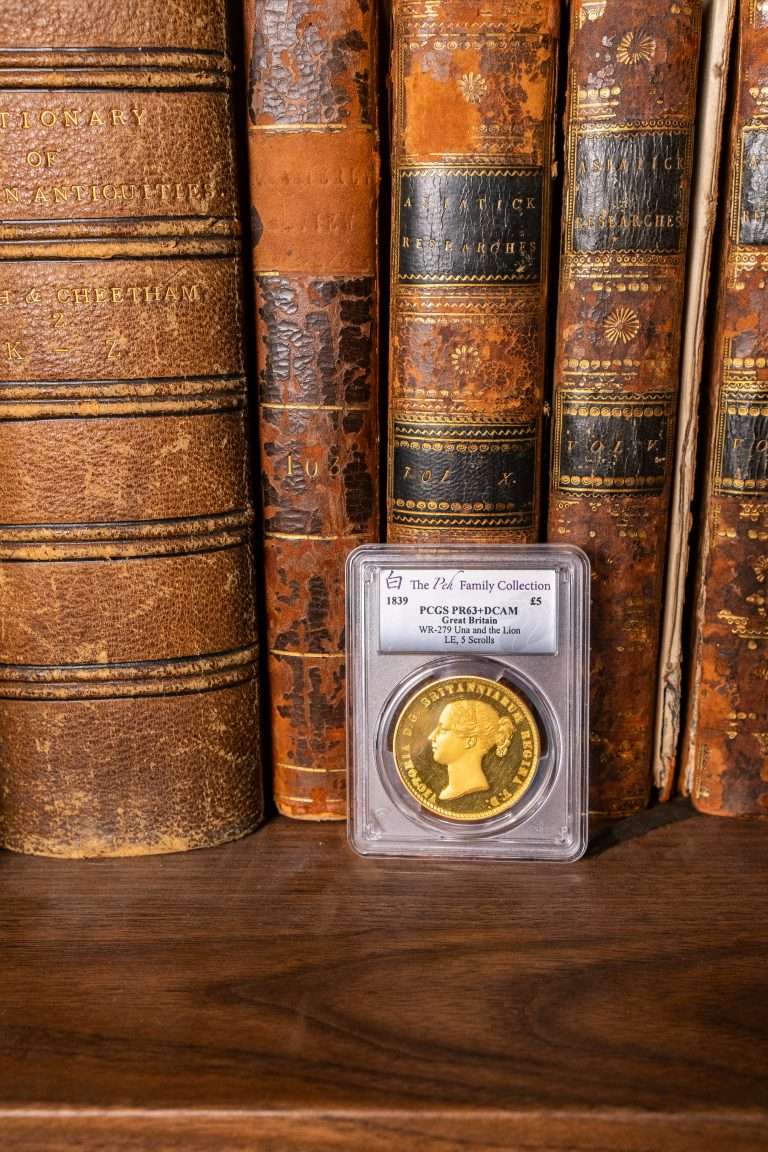

| Collectible appeal | Generally none | Potential for added value |