Financial Planning

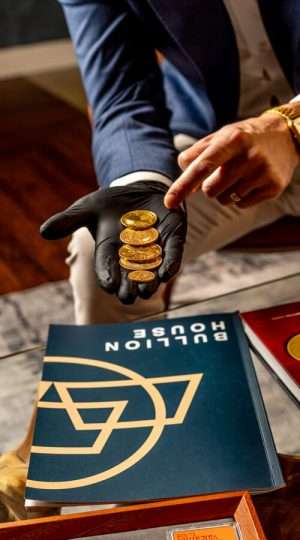

Invest in your future today….and enjoy your wealth tomorrow

CONTACT US

Home / financial planing

Pension & Tax Planning

Have you thought about a gold pension or buying gold for retirement? Bullion House can help you learn more about the advantages of choosing the right gold retirement plan for you.

If you are a UK citizen, then you can benefit from up to 45% tax relief when investing in gold as part of your personal pension.

You can claim tax relief up to the maximum annual allowance, which is currently £40,000 and any gains can be Capital Gains Tax (CGT) exempt subject to rules and guidelines by the HMRC.

There are different approaches to buying physical gold with your pension:

• Buy gold through your existing SIPP or SSAS

• Transfer part of or the full value of your existing pension to a SIPP or SSAS

• Make contributions to a new SIPP or SSAS

For more information please contact us at [email protected]

New Tax Year Changes 2024

For the 2024 tax year, several changes in the UK tax system make gold coins an attractive option for individuals aiming to protect their wealth against Capital Gains Tax (CGT). Here’s a breakdown of the changes and how gold coins offer a unique advantage.

Key Changes to Capital Gains Tax in 2024

The annual CGT allowance has been reduced from £6,000 in 2023/24 to just £3,000 in 2024/25. This reduction means that investors will be taxed on a greater portion of their capital gains than in previous years, making it more costly for those with significant investments in assets like stocks or property. CGT rates vary based on income levels: 10% for basic rate taxpayers and 20% for higher rate taxpayers on most assets, while property gains are taxed at higher rates of 18% and 28%, respectively.

Why Gold Coins are a Smart Investment

Gold coins such as the UK’s Britannia and Sovereign are classified as legal tender, which means they are exempt from CGT. This tax benefit is particularly advantageous for those looking to make substantial investments in physical gold without the concern of future capital gains taxation. Additionally, gold coins provide a level of financial privacy and security against economic downturns, inflation, and geopolitical instability, further solidifying their status as a “safe haven” asset.

Protection and Flexibility

By investing in gold coins, you can capitalize on the tax-free status of these assets while potentially enjoying long-term appreciation. Many UK-based investors consider them a vital part of a diversified portfolio, especially when navigating uncertain market conditions. With no CGT on gains, you can buy and sell these coins without affecting your tax liability, making them an ideal choice to safeguard and grow wealth under the new tax regime.

In conclusion, given the tightening CGT rules, secondary market gold coins offer both financial flexibility and tax efficiency, allowing you to maximize gains while minimising tax obligations. For those interested in exploring the benefits further, a reputable gold dealer can offer a variety of options tailored to individual investment goals.